Table of Contents

Open Table of Contents

Introduction

10%. That’s how much the euro stablecoin market capitalisation grew in 2024.

Last year I predicted that we will either see explosive euro growth or euro share staying relatively similar. The latter was closer to the truth. There are a few larger reasons why the former didn’t take place.

Firstly, I naïvely assumed that centralised exchanges (CEX) would actually follow the deadlines set in MiCA. That is, they should phase out non-compliant stablecoins by the end of June 2024. What really happened is that they ignored this, arguing for the December 2024 deadline applicability. Furthermore, it looks like CEXes are also now taking full advantage of the grandfathering period and arguing for even later deadlines.

The second reason is Circle’s permission, even if just de facto, to issue USDC through a multi-jurisdiction setup. This means that the USDC reserves can be held in multiple regulatory areas at the same time. Whether intended or not, USD stablecoins - partially due to high USD banking costs in Europe - were about to be de facto banned (as I wrote here). However, as Circle can now perform regulatory arbitrage and move reserves into jurisdictions with lower capital requirements, it makes much more sense to stick with USD stablecoins rather than euros. Now that this has been accepted in one EU country, other issuers will be able to replicate this structure in other countries as well. I’m not sure how much the Circle folks dined and wined the French regulators but this will unfortunately and inevitably delay Euro stablecoin adoption potentially by at least three to four years compared to the alternative universe where this didn’t happen.

Issuing dollars in Europe is just simply cheaper than issuing euros.

Now, let’s take a look at how the euro stablecoin market failed to thrive in 2024.

Euro stablecoin market developments in 2024

Trends

Before the data based analysis, let’s speedrun the most important news of 2024:

The first half of the year was “quiet”, at least on the public side. Behind the scenes, all the big actors started waking up to MiCA and shuffled like Gabby David. In April, notably, Tether’s Paolo Arduino stated that Europe was not important for Tether (or Bitfinex). [S] My commentary on the topic here. Lugh also stopped issuing its EURL stablecoin, giving holders only four months to redeem. [S]

June marked the public beginning of MiCA-related activity in the EU. One of the only notable exchanges reacting to MiCA implementation in June was Bitstamp. At the time, it stated it would delist non-compliant stablecoins, including EURt. [S] However, Bitstamp still continues to carry VNX’s euro stablecoin VEUR, which is not MiCA-compliant.

July. Circle made news by blatantly lying to everyone by announcing it had become the “first” MiCA compliant stablecoin issuer. [S] In fact, at least Membrane, Monerium, and Quantoz were compliant much before Circle, which actually was in breach of MiCA for at least 40 working days. FORGE followed similar news just a few hours later with its EURCV stablecoin. The other then compliant issuers did not seem to consider it necessary to reiterate this obvious compliance point.

August. Banking Circle launched its EURI-stablecoin, marking the second bank-backed venture into stablecoins in Europe. [S]

September. Societe Generale FORGE announced its partnership with Bitpanda around EURCV. [S] For context, “partnerships” between exchanges and stablecoins usually mean that the stablecoin issuer pays the CEX based on the total amount of stablecoins held on their platform, total issuance, volume traded, or some combination thereof. Trading volumes remain extremely lackluster with CoinGecko reporting less than 600€ daily trading volume at the end of year. [S]

November. Tether succumbed to regulatory pressure and announced the winddown of EURt on all blockchains. [S] Users have until November 2025 to redeem their stablecoins. In a somewhat contradictory move to their leadership’s comments earlier in the year, Tether also announced its investment to Quantoz, a MiCA-compliant stablecoin issuer. Kraken and Bitfinex also confirmed they’d be listing Quantoz’s EURQ. [S] Schumann, a firm led by an ex-Binance executive, also finally issued its first stablecoins, even though they aren’t being actively used yet. [S, S] Paxos acquired the Finnish stablecoin issuer Membrane. [S]

December. Tether’s forays into regulated stablecoin issuers continued as it announced an investment to StablR, a firm with an equally retarded name to Schuman’s EURØP stablecoin. [S] Unlike Paolo said, it looks like Europe does still have some meaning for Tether. In non-euro news, Coinbase also finally delisted USDt, potentially signalling the beginning of exchange-led MiCA enforcement. [S]

Issuance

The year ended with approximately €320 million issued, adjusted for double counting. Overall, the euro market grew by about 10% YoY, effectively returning to where it was two years earlier. These figures are without adjusting for “fake” issuance which we discuss later. The relative share of euro stablecoins to dollar stablecoins shrank by approximately 30% from ~0.23% to ~0.17%.

Composition

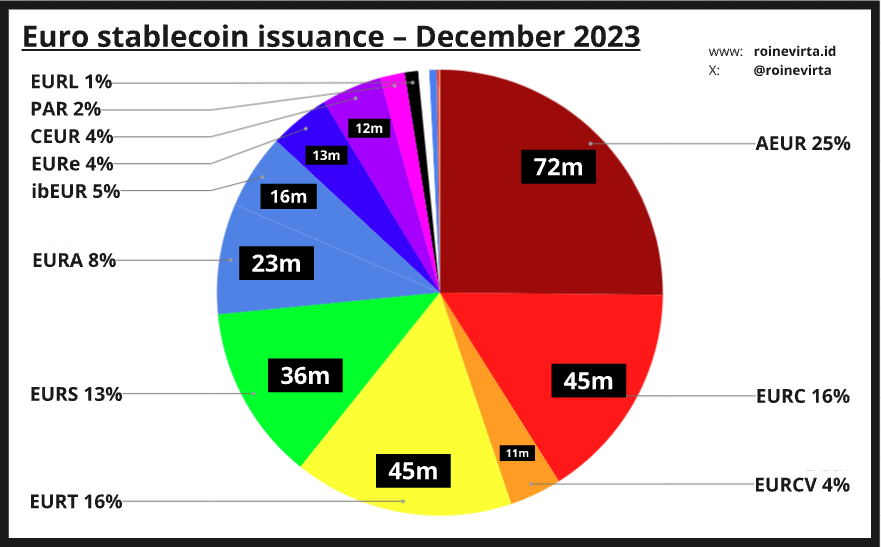

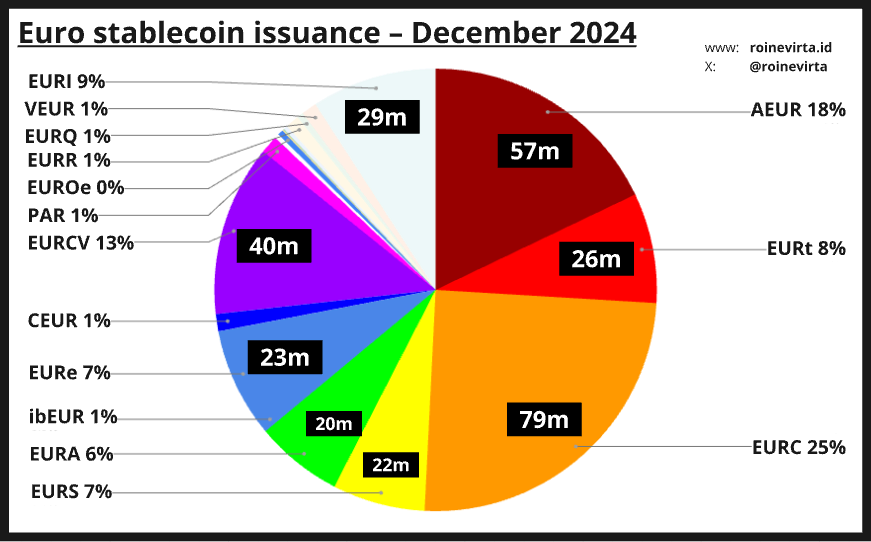

Yet again, the composition of stablecoins, as measured by amount issued, has changed considerably. The largest gainer was EURCV by overtaking six other stablecoins. Even though EURCV might have gained TVL, it is still barely used with less than 400 transactions the whole year.

Lugh’s EURL which wound down its operations was inevitably the loser. Other notable losers are the non-regulated EURS, EURt, and EURA which each lost three places in the rankings.

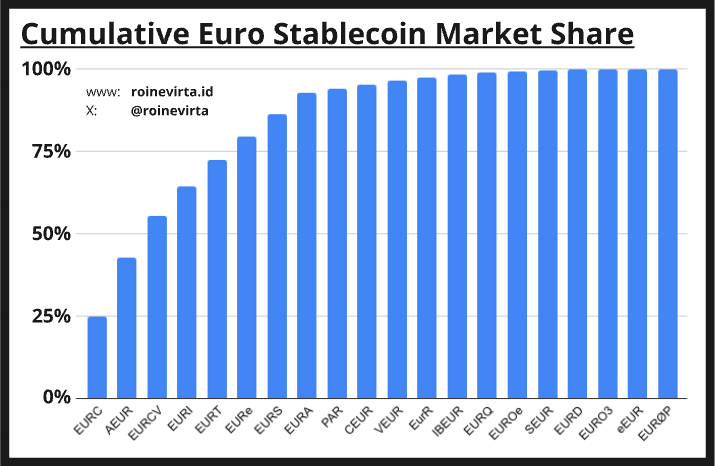

The top 5 largest stablecoins (rank change) at year end are:

- EURC at 79m€ (+2)

- AEUR at 57m€ (-1)

- EURCV at 40m€ (+6)

- EURI at 29m€ (new)

- EURt at 26m€ (-3)

As we can see from the above charts, the landscape has been mostly shaped by the entry of new stablecoins and the winding down of existing ones. Similar to last year, the “shadiest” stablecoins are decreasing in issuance which is positive news for the ecosystem in general.

The dominant decentralised stablecoin, EURA (f.k.a. agEUR) also lost relative market share to others, which may be partially due to Angle’s new USD offering – or the lack of real euro growth, as detailed in the usage section.

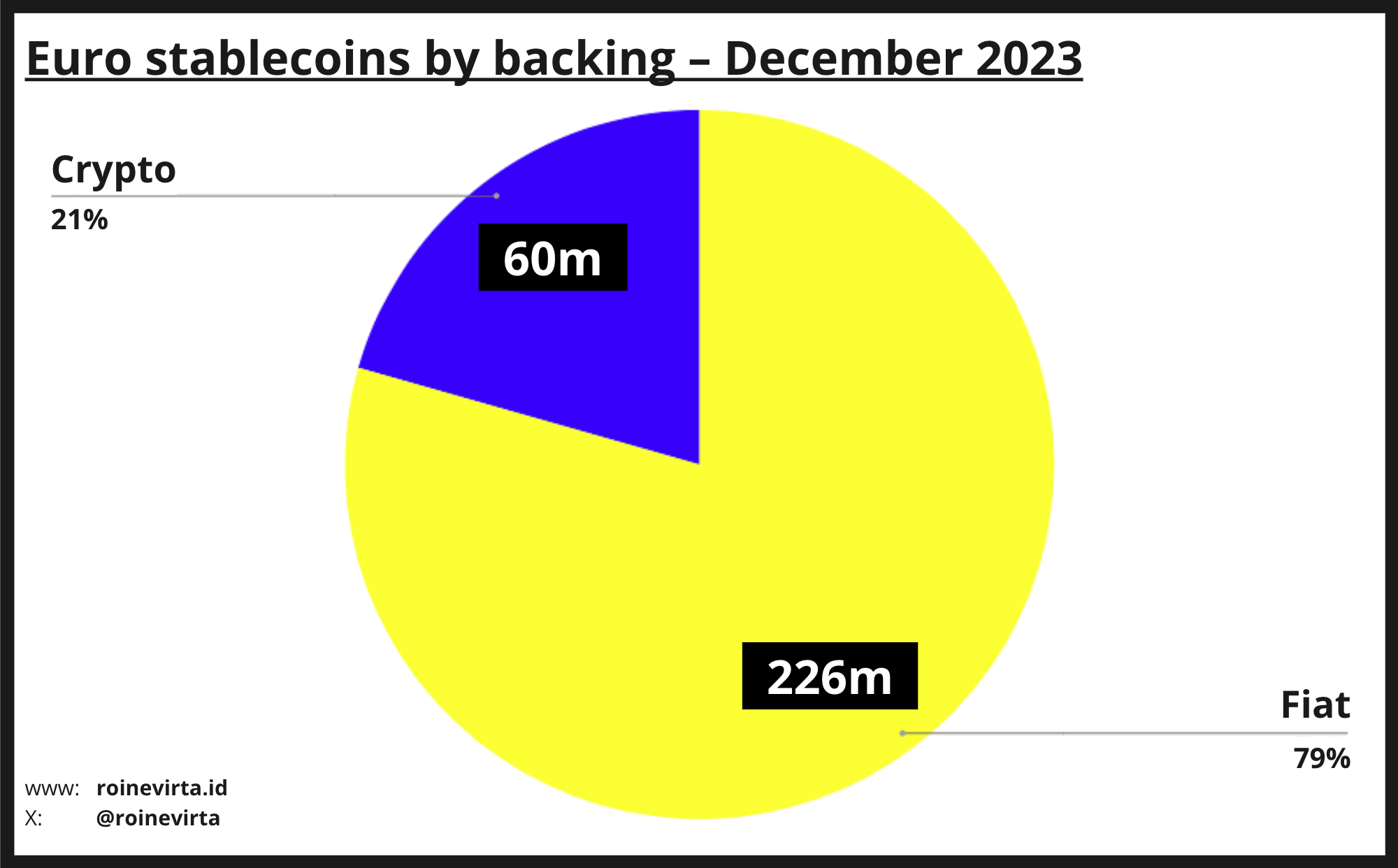

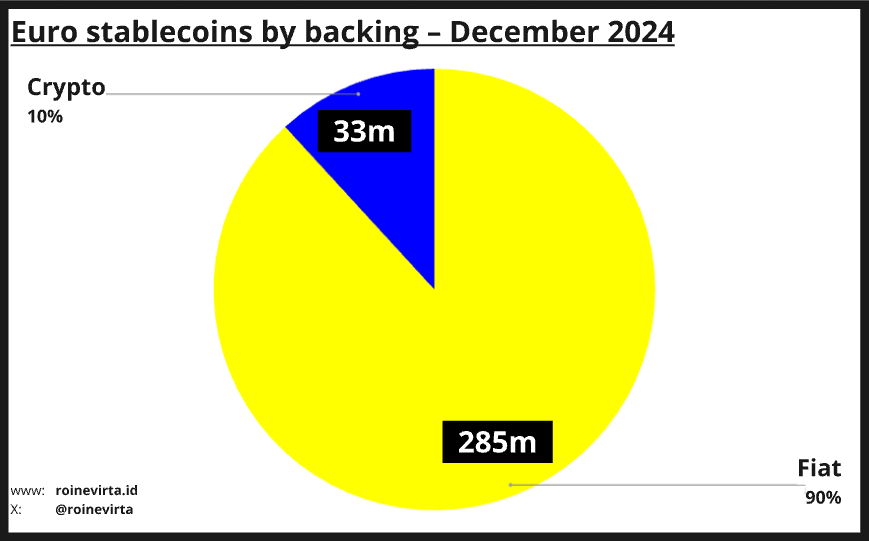

Last year I predicted fiat euro stablecoins would grow larger in dominance in relation to their crypto-backed counterparts. So what actually happened?

Fiat dominance grew from 79% to 90%.

This does not come as a surprise. I now attribute this to two major factors; a) general lack of interest for euro in DeFi, which is the primary supply sink for decentralised issuers, and b) the scares of EU regulation capturing decentralised stablecoins under MiCA’s Title IV because they reference the euro.

During my time at Membrane, which issues the fiat-backed EUROe, I observed that most of our demand and interest was primarily generated by institutional, regulated, or corporate actors. For these, decentralised stablecoins are not even a consideration. On the other hand, DeFi interest was very low. However, this is not helped by the regulatory considerations of centralised stablecoin partnerships with DeFi protocols, or in a more macro view, the lack of sufficient (€100m+) funding for euro stablecoins.

But let’s continue with the statistics.

The next one is for the European Commission, ESMA, and EBA. They must be patting themselves over their backs with both hands.

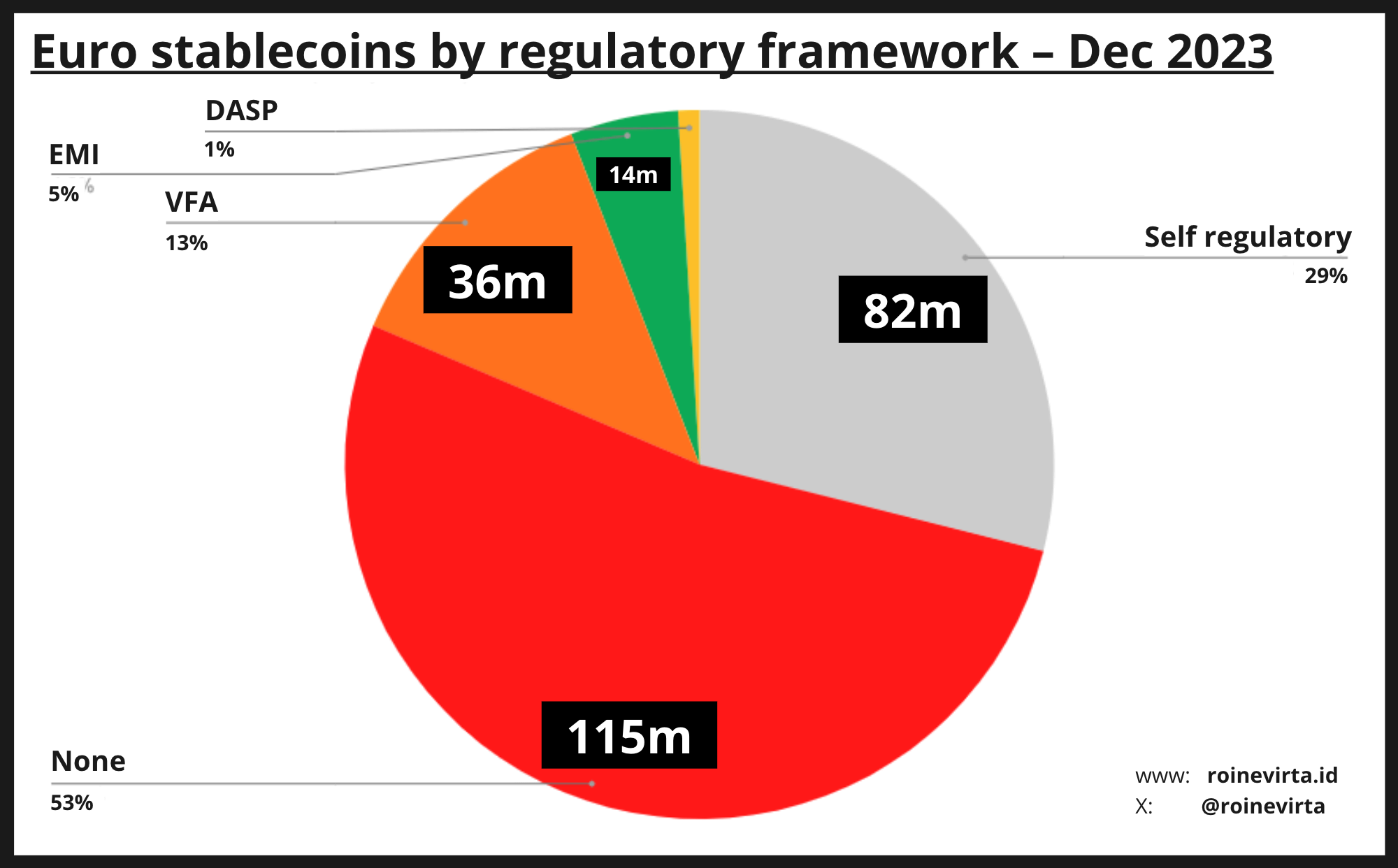

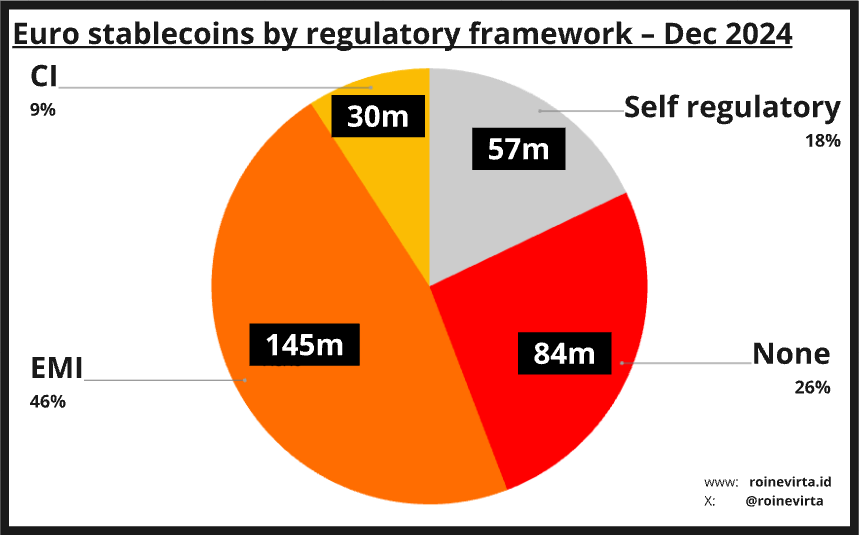

As we can see, the share of stablecoins that are captured under EU regulation grew from 19% to 54%. Electronic Money Institution (EMI) issued share of stablecoins went from 5% to 46%, whereas Credit Institutions entered the market and took a 9% slice out of the box. The other EU frameworks, DASP (France) and VFA (Malta), are no longer relevant.

Those that are not subscribing to any regulatory framework, such as EURt and EURS, are being wound down or will likely be forced out of the market. Hence Tether’s investments into other issuers. The remainder under the “None” section will likely be only decentralised stablecoins at the end of 2025. The only self-regulatory issuer, out of Switzerland, is Anchored Coins’ AEUR which will likely also be slowly wound down due to its inability to penetrate the European markets in the future (no exchange listings).

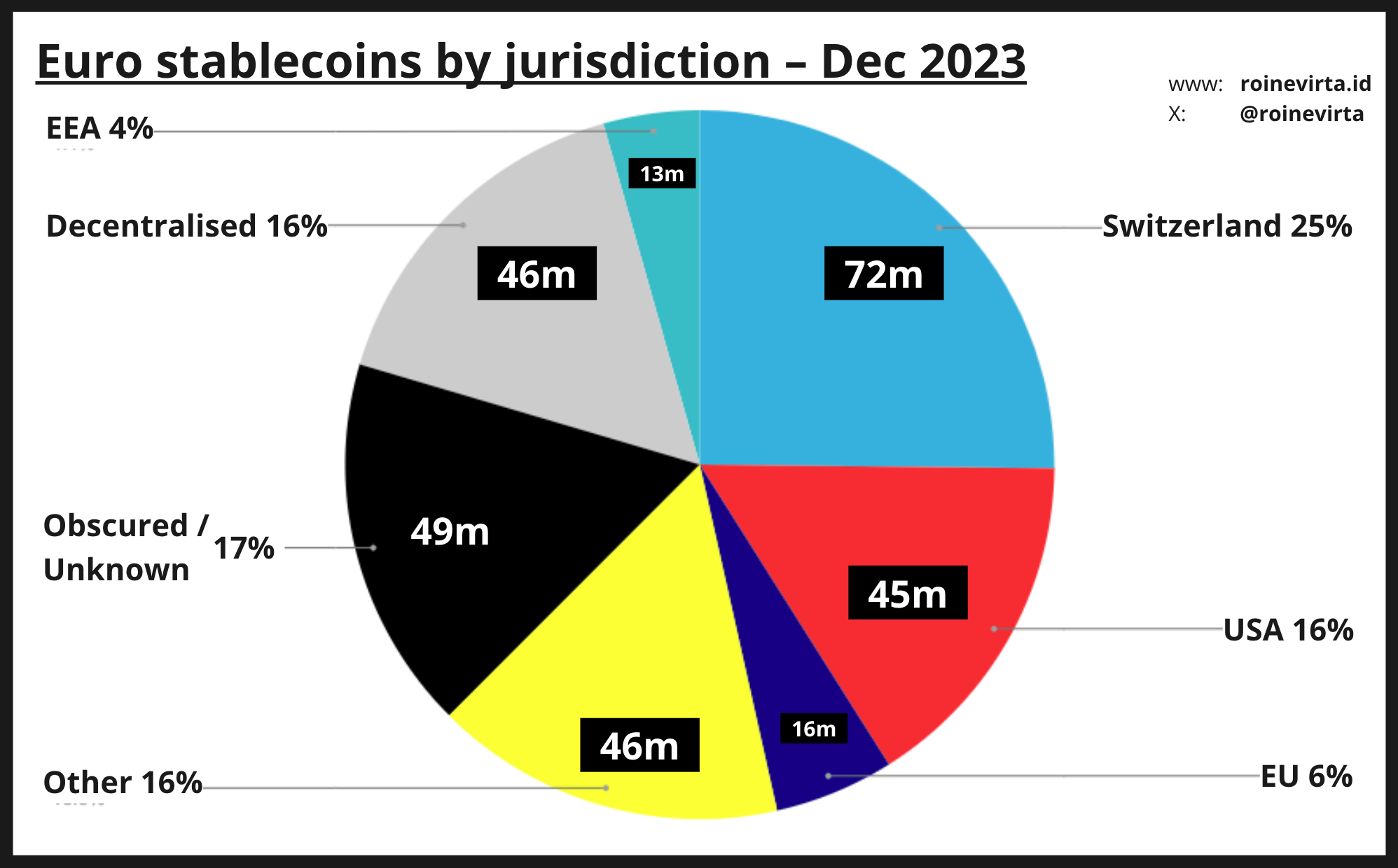

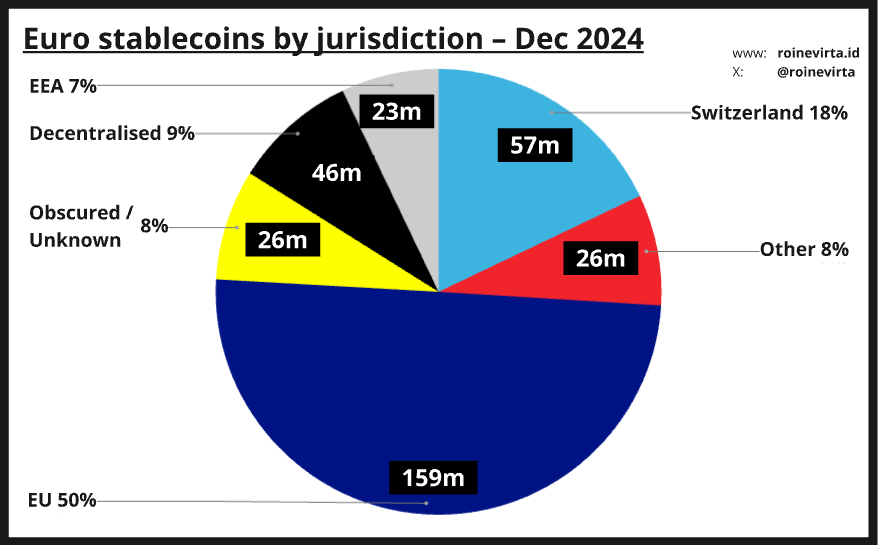

Jurisdiction-wise we saw movement into the EU, even though the ultimate beneficial ownership might be ex-EU.

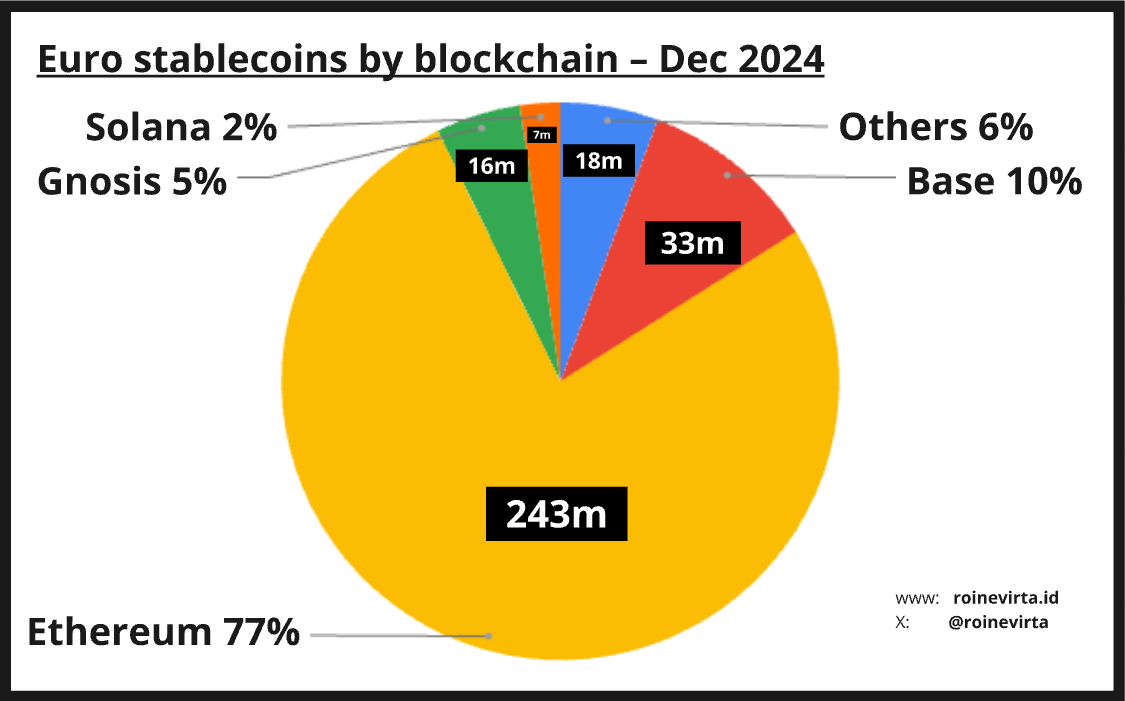

Ethereum still remains the dominant euro-blockchain with Base second and Gnosis third. Solana is by far the largest non-EVM compatible blockchain for issuance at 7m, tharfing the second non-EVM placeholder Stellar by a factor of ~3. Approximately 4% of all euros are issued on non-EVM blockchains.

Market map

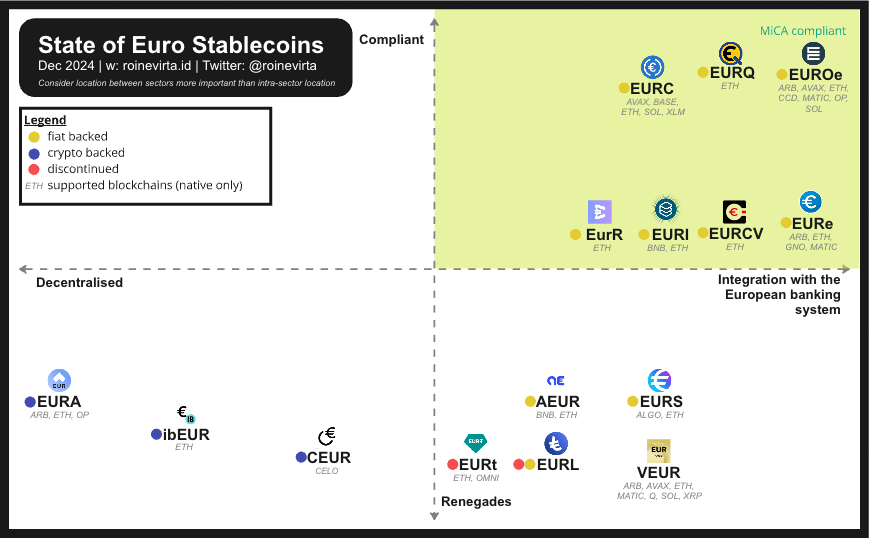

Given the number of stablecoins that stopped operations, the total number of issuers stands at about the same figure of 20 as last year. Power law still applies with euros having a Nakamoto Coefficient of just three.

The maturity of stablecoins has also increased with new market dynamics uncovered over the past year.

There has also been great differences on how seriously various stablecoin issuers take MiCA. From public documents, it is easy to evaluate who publishes and includes marketing communication disclaimers, who has a compliant whitepaper, and so on. Most of the “MiCA compliant” stablecoin issuers, including bank-backed ones, do not have these things under control.

At the other end of the spectrum, different decentralised stablecoins show different levels of decentralisation. If playing with decentralised euro stablecoins, maximising decentralisation would be core so as not to have an identifiable issuer.

Key market participant analysis

Circle’s EURC – Fake it till you make it!

EURC debuted mid-2022 and is today the largest euro stablecoin by market capitalisation. But it’s growth hasn’t been smooth or clear. Back in 2022 Circle quickly ramped up the then EUROC supply to over 80 million until they most likely had a strategy meeting and decided to relax until MiCA enforcement begun, so as not to upset the discussions with the French regulators.

Similarly to USDC, Circle’s focus with EURC is primarily on non-retail, non-DeFi side. Developer experience and corporate adoption are key, but Circle’s overall efforts have been miniscule in relation to those it continues putting into USDC. This is understandable given the high costs of operating euro stablecoins which stem from capital requirements and regulatory costs in a still relatively small market.

But even with these relatively small efforts, Circle’s name, signalling, and loose balance sheet has helped it ensure that EURC is the dominant stablecoin.

Circle long operated EURC illegally; prior to MiCA it should have been issued by an EMI. It wasn’t. When MiCA came into force, Circle still operated a few days without an EMI. That was then followed by at least a 40 business non-compliance period. For a long time Circle did not offer redemptions on many of the blockchains it natively operated on. Their whitepaper still continues to be non-compliant. [S]

But this is irrelevant because Circle has an indescribable stranglehold on the industry and the media. When challenging journalists about Circle’s false statement of being “first MiCA compliant stablecoin” (that also made it to Coinbase’s investor letter (ouch)) the responses ranged from “ok, so what” to “trust me, it’s okay” and “I am not in a place to question their compliance, I only report based on their press release”.

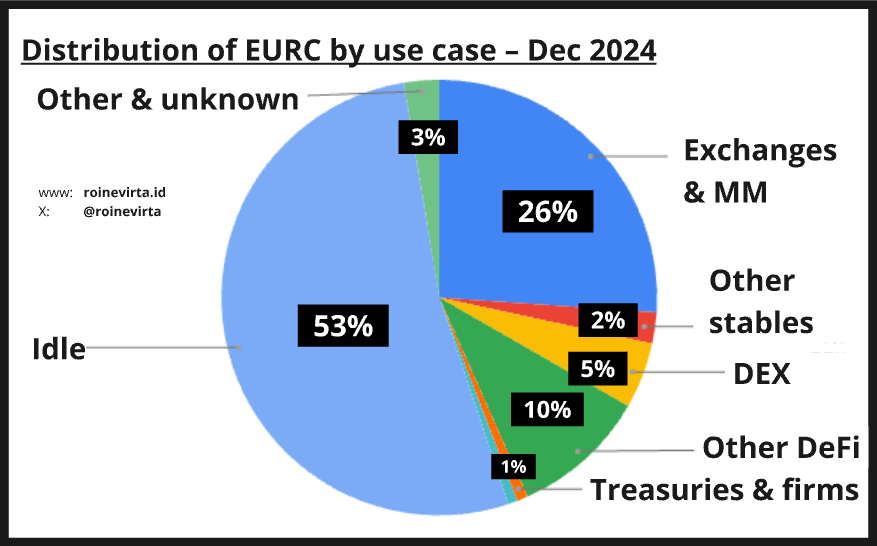

But enough of that. If it wasn’t for Circle’s loose balance sheet operations, i.e. minting EURC for themselves, EURC wouldn’t be in the “largest euro stablecoin” position today. Well over half of all EURC issued is held by Circle or by wallets which only minted & burned EURC without doing anything much else. You can check the blockchain for yourself and see the large amounts of idle EURC just sitting there (e.g. 87% of all EURC on Solana is sitting in Circle’s own wallet at the time of writing).

From personal experience, I do not know anyone using EURC. Instead, they use EURe, EUROe, EURA. Not EURC. Even Circle’s own portfolio companies do not use EURC.

Therefore, it is hard to analyse what EURC’s real impact on the crypto-economy is. Is it really being used? Is it Americans posturing? Hard to say.

But one thing’s for sure. Circle is a bad actor, especially in the euro space, and I wish best of luck to all European issuers fighting them.

Banking Circle’s EURI – The only bank-issued stablecoin

Eurite, or EURI, is perhaps the most interesting entrant this year. It is the only euro stablecoin issued by a credit institution – a bank. EURCV is issued by an EMI subsidiary of a bank so it doesn’t qualify. This is a real bank, doing real fractional reserve banking on-chain. This means that their cost of capital is extremely low compared to EMI issuers, giving them a huge upper hand. Losing against other issuers would be just embarrassing.

EURI is issued on both Ethereum and on Binance Smart Chain (most likely due to a partnership with Binance). [S] While adoption has not been explosive (less than 600 holders at year end), it has not been super slow either. EURI’s supply on Ethereum stands at 29 million and Binance is still yet to open their floodgates (it still lists AEUR [S]).

While there’s still little data to share, this might be the most interesting stablecoin to watch for 2025.

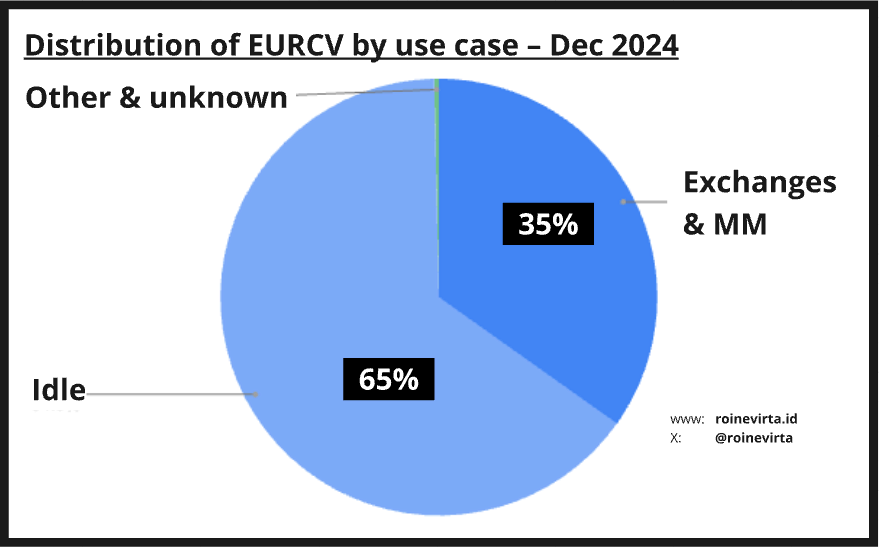

SG Forge’s EURCV – The bankers’ mistake

On the other end of the bank-supported stablecoin spectrum is EURCV. They launched prior to MiCA with a whitelisting feature and have been clearly struggling with adoption and usage. While almost 40m tokens have been issued, these mostly sit idle with less than 400 transactions over its whole lifetime. [S]

Needless to say, SG FORGE really botched their go-to-market, perhaps mistakenly assuming the crypto-ecosystem would welcome bank-related actors with open arms. But Forge is not giving up as they are planning for a Solana launch. [S]

Should Forge be able to reduce bureaucracy or hire someone who knows something about crypto, the battle between EURCV and EURI might be one to watch. With the current team and execution speed, though, I suspect EURCV will continue targeting slowly moving more institutional use cases. These in turn are not visible to the crypto-native actors in day-to-day.

Monerium’s EURe – The best consumer euro on/off-ramp

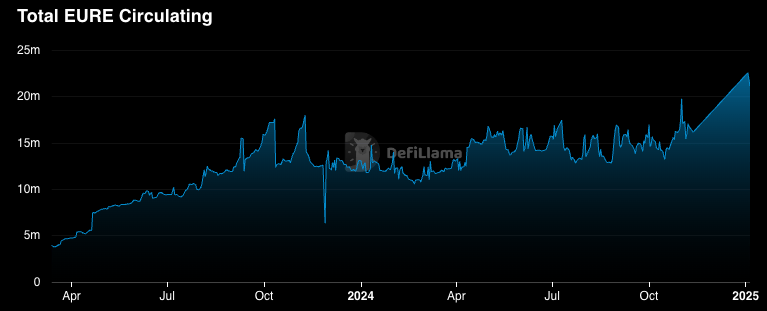

Monerium, one of the most OG euro stablecoins, has continued its growth steadily in 2024. Starting the year at 13m, EURe’s supply grew to nearly 23m by end of year. EURe is dominantly issued on Gnosis, which represents 71% “marketshare” for EURe issuance.

While Monerium’s retail-facing app provides a great consumer euro on/off-ramp, its adoption is curtailed due to limited on-chain liquidity and cross-chain availability, a common problem for all euro stablecoins. Yield opportunities, the bane of all consumer stablecoins, are also limited to mostly Gnosis and scalably just a tiny bit larger than the ECB deposit facility rate.

Moneriums’ overall YoY growth was ~77%, which is a good result relative to other euro stablecoins. Temporary limits on onboarding new users most likely reduced growth. Tailwinds are ahead with the increasing adoption of Gnosis Pay cards and the recent retail-alignment from an extension round with angel/retail participation.

The biggest challenge for Monerium in 2025 will be navigating cross-chain strategy and keeping the unit costs sufficiently low to continue serving retail users directly. Additionally, all the challenges I listed last time (scalability, MiCA in Iceland, secondary market access, focus, distribution partnerships) still apply.

Best of luck to the Monerium team again for 2025.

Quantoz’s EURQ – The boomer stable

Quantoz issues two euro stablecoins; EURD and EURQ. While EURD has been issued for some time on Algorand, Quantoz introduced the new EURQ stablecoin in 2024, together with a USD referencing USDQ. Supply of EURD has been on a downward trajectory, and I wouldn’t be surprised if it were to be phased out in favour of a focus on EURQ which is issued on Ethereum instead of Algorand. Who issues on Algorand?

Kraken announced its support of EURQ in November but, as with most euro stablecoins, trading volume has been low. [S, S] EURQ has no DeFi or crypto-native integrations to speak of, making it effectively useless as of today.

However, the story of Quantoz might be slowly maturing from a boomer stablecoin issuer to something more useful. Quantoz originally debuted with a P2P payment app on Algorand for EURD. [S, S] Hopefully with the recent investments from Kraken and Tether, Quantoz gains a better understanding of how to actually serve the crypto-market and stops focusing on Algorand.

There’s still little data available for EURQ but Quantoz could become an interesting firm to watch – if there are large changes to strategy and execution ability.

Angle’s EURA – The largest decentralised euro stablecoin

Angle’s EURA (f.k.a agEUR) still remains the largest decentralised euro stablecoin. It is natively issued on four chains; Polygon, Arbitrum, Optimism, and Ethereum. Total EURA issuance contracted slightly during 2025, potentially due to Angle’s introduction of its USD referencing USDA stablecoin.

Today, EURA reigns supreme in the decentralised category with no close competition; CEUR, the second largest crypto-backed euro stablecoin, is approximately 25% of the market capitalisation of EURA. Among all the euro stablecoins, EURA has the most meaningful DeFi integrations and some of the best on-chain liquidity; feats that come natively to a crypto-backed stable.

Angle’s challenges in 2025 will continue to be around exchange adoption for distribution and the overhang of regulation. These are extremely pertinent issues for decentralised stablecoins whose third large hurdle (after initial liquidity and integrations) to fame is around real-world accessibility and usage. For example, Angle announced a partnership with Bleap in early December where users could spend USDA and EURA 1:1 with their debit cards. [S] As the Polish’ Bleap’s legal counsellors wake up to the fact that they cannot offer services for non-MiCA compliant EMTs, Angle’s tokens will quickly get removed from the service.

This is the story that will be reverberated throughout 2025 as various non-EMI/CI stablecoin issuers realise the gravity of MiCA. Whether decentralised euro stablecoins have a place or a problem to solve in the mid-term (2-5y) will be seen. Angle’s success in 2025 will be vital, not just for Angle but for euro stablecoins in general. Should Angle not make it, there is no serious decentralised competition to fill the void. And without decentralised competition, centralised issuers will fail to innovate.

Usage

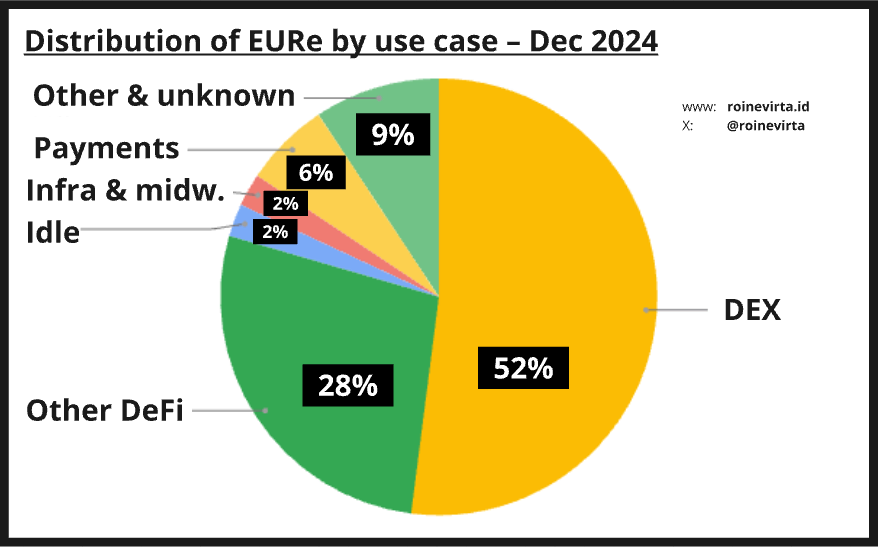

This section is based on data from the six largest euro stablecoin issuers by market capitalisation and is not reflective of all stablecoins in the space.

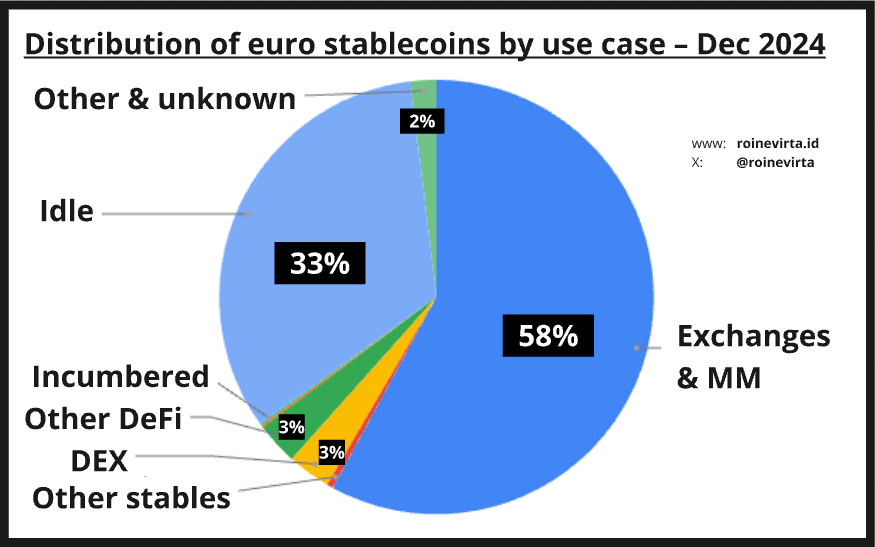

Where are euro stablecoins used today? TL;DR: they aren’t. They just either sit on exchanges, market makers’ balance sheets, or are idle. When analysing the top 6 euro stables, with a combined market share of ~80%, most of the issuance is pseudo-fake. They are not being used on-chain, but to only facilitate trading on exchanges or simply minted to seem more important.

Idle funds are roughly wallets that have only inflows in gas asset + stablecoin, don’t have meaningful amounts of other assets, and have not had meaningful outflows. As we can see, the landscape is rather dominated by parking funds at exchanges. So why do I say parking funds at exchanges?

Let’s analyse some data in regards to the euro stablecoin “aligned” exchanges (Binance, Coinbase, Bitstamp, Kraken). Given the high proportion of euro stables in exchanges, we could assume that they do facilitate a disproportionately large share of trading versus their USD counterparts, right? The benchmark to beat is 0.17% (the USD/EUR stablecoin ratio).

We observe that ¾ exchanges do not list volatile EUR stable pairs, such as BTC/EURx or ETH/EURx. Instead, they just list a stable-fiat or stable-stable pair such as USDT/EURx or EUR/EURx. Binance is the only one doing volatile pairs; it lists a BTC pair against EURI. This BTC pair facilitates <1% of the trading volume its EUR fiat counterpart does. And compared to the USDT and FDUSD counterparts, the EURI pair facilitates ~0.01% of trading. This is well below the 0.17% benchmark, indicating that euro stablecoins aren’t really being used on exchanges for trading either.

So exchanges are a great place to “park” funds to appear more meaningful than you are!

But some just prefer to truly sit the funds idle, not even park them at exchanges. 53% to 89% of EURC’s issuance could be considered “fake”; add exchanges (Coinbase) and other DeFi (i.e. lending in this case) to the idle funds and you have a very large buffer of funds that have a low cost structure. The conservative idleness figure would probably be somewhere between 54% and 73% (it is unlikely exchanges & market makers actually need as much inventory as is reserved).

But EURCV, the banker-stable, is even more egregious in their actions. Instead of hiding the unused funds across tens of exchange and idle wallets (like Circle does), they have them in just a few wallets.

The only euro stablecoin with actually “normal” distribution patterns is EURe.

Their large DEX distribution indicates a strong DeFi-native knowledge, grassroots adoption, and the lack of exchange partnerships. Their “organic” growth has definitely been helped by their retail facing application which in itself facilitates payments to/from crypto.

Monerium also has good integration across other DeFi and it is also used within the Gnosis Pay card and in various unidentified use cases. Needless to say, of the six largest stablecoins, EURe has the most real adoption. This one is the one to watch out for.

Challenges

The euro market saw muted growth. This is its primary challenge. Once we see a 10x or a 20x year, there is hope. Until then euro stablecoin issuers still need to keep on grinding for PMF and adoption.

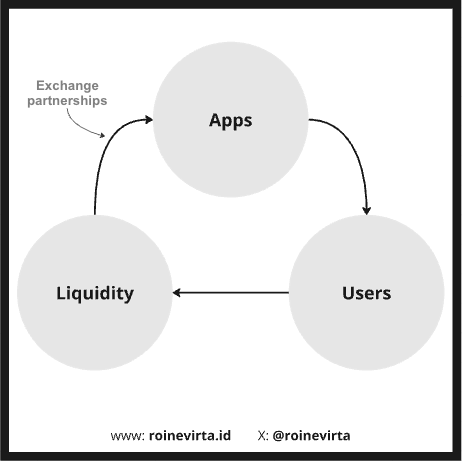

Last year I stated that the problem for growth was driven by these factors: a) the chicken and egg problem, b) lack of understanding, c) gatekeeping, and d) lack of availability & accessibility.

Due to the developments in 2024, point d is slowly getting solved. With Kraken, Bitfinex, Coinbase, Bitstamp, and many others offering or starting to offer euro stablecoins, accessibility concerns are now making room for newly emerging challenges that block major adoption.

The challenges in 2025 will revolve around a) the chicken and egg problem, b) lack of understanding, c) liquidity, and d) turfwars.

I hope the chicken and egg problem, referring to the fact that users do not come unless there are apps won’t come unless there is liquidity won’t come unless there are users, will see signs of improvement, as shown in my updated graph. But truthfully – that is unlikely. As one market observer puts it:

EU issuers are either small startups with limited budgets, or large EU banks with a more conservative approach. These banks don’t see stablecoins as critical to their core business and therefore move more cautiously.

The bull case for the euro market is that the exchange partnerships, mentioned at the beginning of the trends section, will drive both liquidity and better access. Liquidity must come as euro issuers don’t get to list unless they can fulfil certain liquidity KPIs (e.g. 100k 5bp spread 99.9% of the time) on tier-1 exchanges. The increased availability from exchanges will also lower the barriers for apps, both DeFi and non-DeFi, to try out euro stablecoins.

Therefore, the larger problem is a lack of understanding, this time around not just from users (who risk fx exposure) but also from issuers. We have seen a noticeable change in who is serving the crypto-ecosystem. It’s more and more about institutional actors (vs. smaller start-ups). While they can hopefully bring the liquidity (problem c), they are less likely to engage DeFi venues in the short-term. This means that the trickle down to everyday degens like me will take slightly longer.

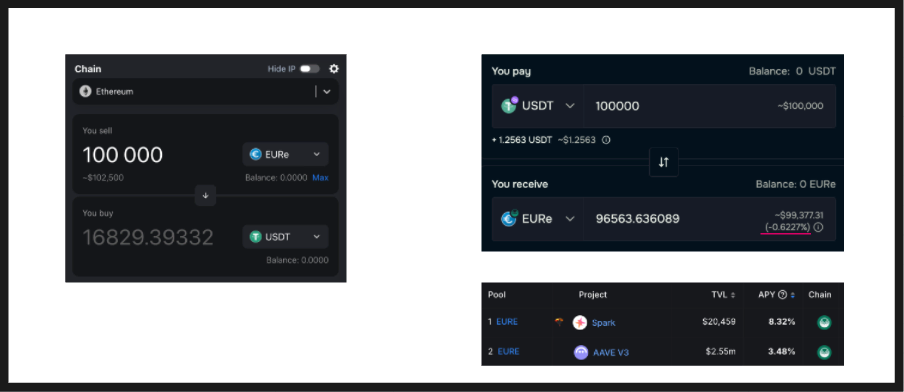

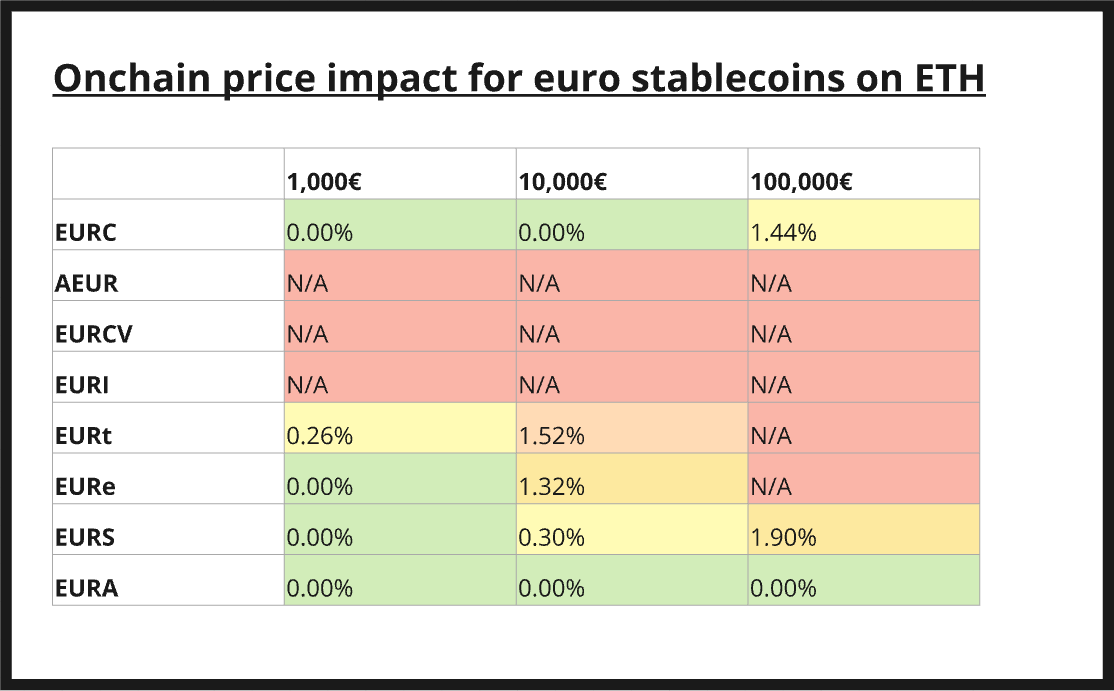

But the largest problem remains liquidity. If I cannot trade 100k on-chain with less than 1% slippage, I’m not going to do it. This means that stablecoin issuers need more funding. Much more funding. In fact, I would venture to say it is useless to start issuing stablecoins unless you have at least €100m in funding.

On the liquidity front, EURA – a crypto backed stablecoin – is the only who can deliver a great swapping experience, thanks to their hybrid CDP + transmuter design. [S] Fiat backed stablecoins face a harder problem due to the unavailability of collateral to trade against on-chain; euro fiat collateral is idle from a end user perspective.

With the current deterioration of Europe, I find it unlikely that liquidity problems will be fixed any time soon. Especially now that issuing USD out of Europe is cheaper than issuing euros.

While not an outright blocker to growth or adoption, stablecoin issuers will be challenged by exchange turf wars. We are already seeing replication of what happened with USD stablecoins, though this time even more vigorously as exchanges know what kind of money we might be talking about.

Kraken has aligned with Quantoz. Coinbase has aligned with Circle. Bitfinex has aligned with Quantoz, and indirectly StablR. Bitpanda with EURCV. Bitstamp with VEUR (for now). Binance will likely align with EURØP. Monerium hasn’t aligned with anyone and will feel it. These turf wars, especially with exchange L2s (BSC, Base, and now Ink), will fragment access and reduce the overall experience of using euro stablecoins. This is a challenge both for users (UX) and issuers (capital efficiency).

Opportunities

Anna from Perena, a Solana-native AMM aiming to reduce liquidity fragmentation, is cautiously optimistic about the prospects of euro stablecoins: “Don’t underestimate the EU and therefore the Euro’s influence on the regions’ economy and cross-border activities. While crypto may think that EUR is a niche product, on a global scale across industries, EUR plays a major role in inter-European trading as well as European exports.”

I share her view of the large opportunity for euro stablecoins in the medium to long-term. Therefore, the opportunities available for euro stablecoin issuers are mostly in the 3y+ range. This means:

- Ensuring operational resilience, scalable core business, and decreasing fixed costs to enable profitability in the long-term

- Establishing great banking connectivity and crafting a superior UX when swapping between on- and off-chain versions of money

- Reduced investment in DeFi for this cycle with focus on enterprise and institutional use cases to find low cost supply sinks and establishing credibility

- Trying out new business models supplementing stablecoin issuanceto craft a long-term moat, most likely under PSP type activities

Running a stablecoin is not as good a business as many think – while you are at low scale - and the short-term is about staying alive. Therefore, reducing cost is important while you try things and find your rocket ship. Previously, these rocket ships have been solely exchange partnerships, acting as the first step in scalability and accessibility.

Now with clearer regulation and the maturity of actors in the space, however, the rocket ship does not to be an exchange. It can be a more traditional, boring business like an ERP provider or a cross-border payments use case. And then it becomes a “normal” start-up problem about finding PMF and iterating until you succeed.

If I were tasked to find quick wins for a euro stablecoin issuer in 2025, they would be:

- This is a bit iffy in terms of the mobilisation timeline but getting stablecoin payments into an existing enterprise resource planning (ERP) platform. It is a high risk approach but if, for example, an actor like SAP were to lock in to a certain issuer, they could create a huge liquidity sink as different enterprises move funds within the platform to pay and get paid from various others that use SAP.

- Contrary to what I’ve said about DeFi, this still remains a relatively low-cost area to win. If you have sufficient capital availability (even 10m) and risk tolerance, gaining a liquidity sink from DeFi could be doable. But don’t put a banker in charge of DeFi, that is destined to fail.

- Streamlining global remittances corridors and inter-EU payment acceptance in partnership with existing actors such as InFlow or Coinflow. This is not a huge liquidity sink relative to payment volume so your fiat operations must be cost effective.

In general, you will want to find places that create a sticky destination for your stables with minimum redemption volumes. There are plenty of such destinations out there. Choosing and winning over the right ones is a huge effort.

What’s in for 2025?

Unlike in 2024, I am rather pessimistic about the euro’s future in the short-term. As Anna puts it “SEPA and EU’s progress in Fintech may actually be a short-term disadvantage to EUR stablecoin adoption.”

Here are my predictions for 2025:

- Don’t expect significant market share growth over USD, but expect increasing euro issuance as the first “legitimately” institutional and regulated venues utilising euro stablecoins come online (onchain?).

- New issuers will still pop-up but will not succeed unless they have significant funding or are part of larger organisations.

- We will see a few new bank stablecoins which may be somewhat successful in their respective focus areas.

- The share of non-regulated euro stablecoins will continue to shrink.

- Solana becomes more important for euros, gaining a larger share of – perhaps even 10% – of total euro issuance.

That said, I hope that the exchanges would start fighting each other on euro dominance, trying to secure a moat before it is too late. This is the only bull-case for explosive euro growth in -25.

Closing notes

Thank you for joining me on this tour de stable! If you found this piece helpful or informational, I would highly appreciate it if you would share it within your network. You can also follow me on LinkedIn or Twitter.

If you’d like to continue the discussion about onchain euros, we have a Telegram group titled “BRING EUROS ON CHAIN”. You can join it here.

All markets and numerical data have been compiled over Jan 3-5, 2025. If you think some of the data presented herein is false or inaccurate, please DM me and we’ll get it fixed. All currency conversions have been completed using the relevant day’s rate.