Does it matter which blockchain you build your dApp on?

There’s been some discussion around this on CT recently, each pushing their own narrative.

Table of Contents

Open Table of Contents

Methodology

So let’s take a look at some data. For the below analysis I fetched data for the largest dApps in each of the analysed categories (DEX, lending, derivatives) based on its TVL today. I’ll be using TVL, not revenue, as this is easier to quantify. I only chose dApps that did not exist previously. If a dApp had multiple versions, I choce the first version, and in the case that there were multiple versions launched at the same time, I chose the one with higher TVL (example: Thruster V3).

This was done to avoid bias due to prior history, status, and established distribution channels. In other words, the dApps analysed here are category winners on their respective blockchains with no prior history. Unfortunately, I had to make some minor modifications to the methodology due to data availability issues (e.g. Orca replaced Raydium).

Graphs

Please note that the graphs skip the first 30 days of data.

Blockchain

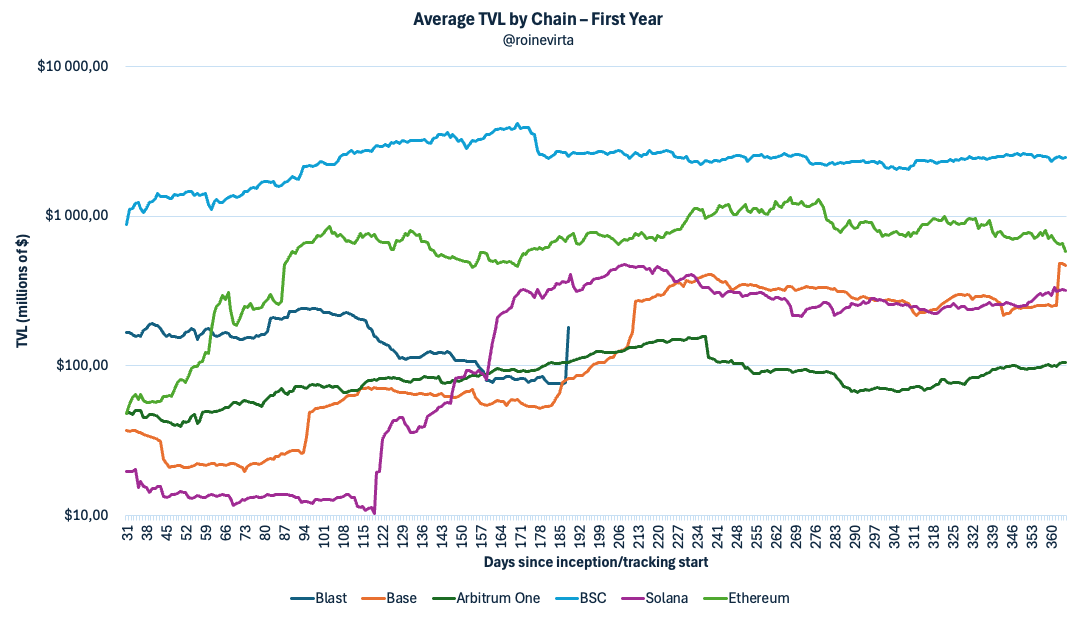

The above graph shows that there is a significant difference between the TVL of dApps based on the chain on which they are deployed on. A few observations:

- The difference between the chains seems to close as the dApp matures

- The difference between the “best” chain (BSC) and the “worst” chain (Arbitrum One) is ~14x after a year

Please also note that we still don’t have full year’s worth of data for Blast

Category

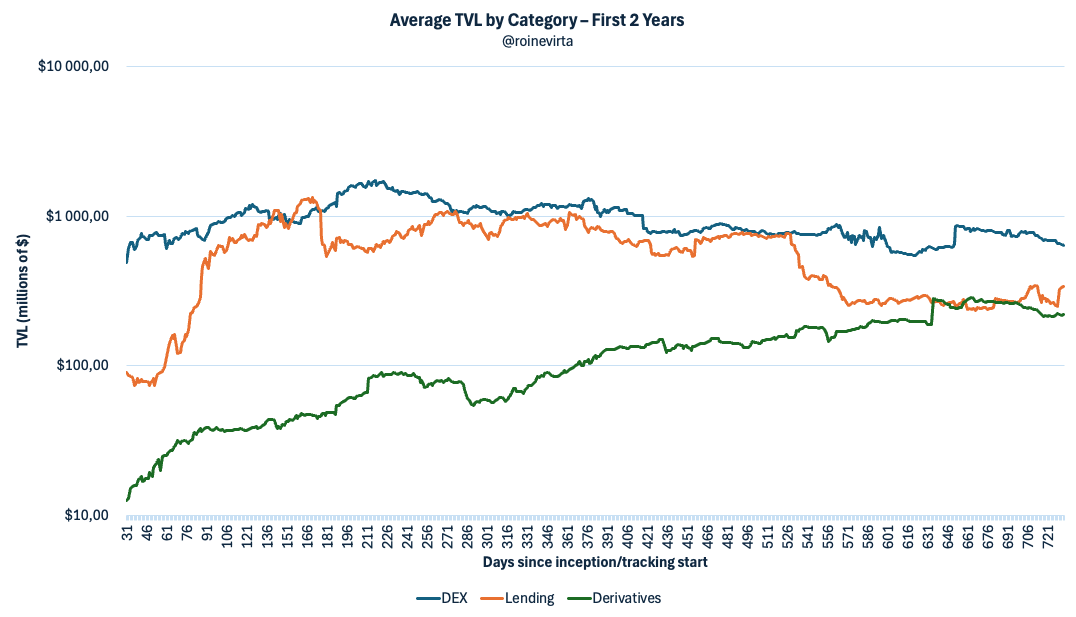

Here we can see that DEX’s start with the highest TVL but all three categories tend to converge towards more similar TVL over time.

Launch year

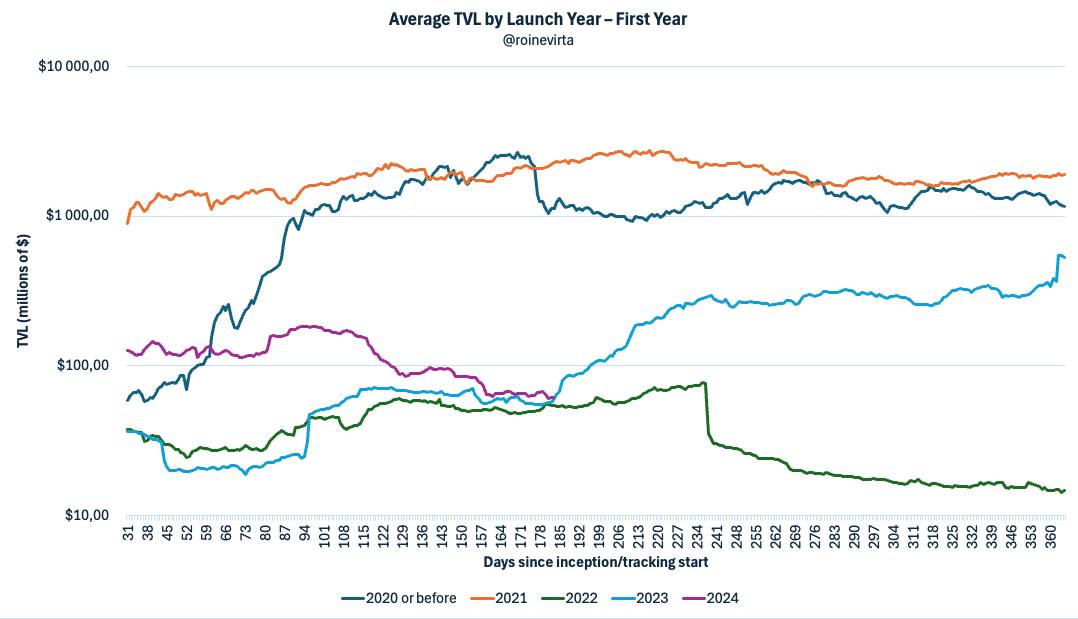

One confounding factor in the blockchain data might be the year on which the dApp was launched. In the data set used, Ethereum dApps were launched earliest (on average, Q3/2019) whereas Blast dApps are the newest (Q1/2024). Comparing to market cyclicality, BSC dApps were launched closest to the Nov ‘21 cycle picotop (average Q3/2021). Arbitrum dApps, on the other hand, are closest to the bear bottom of Dec 2022 (avearge Q2/2022). This likely has an impact to the first year performance of dApp TVL.

My gut feeling is that market timing is actually more important than the blockchain choice. As an other example, Base (as an ecosystem) has been growing steadily and quickly with its average dApp launch in Q4/2023, coinciding with positive market sentiment at least for 2~3 quarters.

Conclusions

To derive proper conclusions, we should take a more data-heavy approach and inspect the potential impacts of market timing, sentiment, and other factors than just the blockchain. Data indicates a maximum difference of a factor of 15 in dApp TVL after a year, but my gut feeling after pouring over my little data set for a few hours is different. If the blockchain you are on has good access to existing TVL, good connectivity to non-blockchain financial systems (SEPA, SWIFT, cards…), and it has low enough fees & high enough TPS for your use case, go ahead. Depending on what you are building, the ecosystem of other dApps, grant programs, specialised infra, or ecosystem help might be more important than any of the quantitative data shown here.